DSCR Investment Loan

The DSCR or debt service coverage ratio is the relationship of a property’s annual net operating

income (NOI) to its annual mortgage debt service (principal and interest payments).

income (NOI) to its annual mortgage debt service (principal and interest payments).

Commercial lenders use the DSCR to analyze how large of a commercial loan can be supported by the cash flow generated from the property, or to determine how much income coverage there is at a certain loan amount.

Two of the most important factors used to determine the approvability of a commercial mortgage request are the DSCR and loan-to-value (LTV). Often times the loan amount may be debt service constrained and the maximum LTV not obtainable.

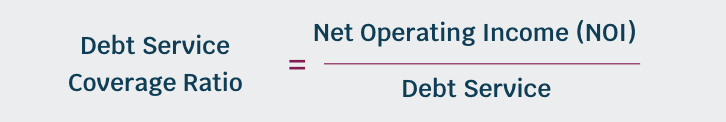

Calculating the debt service coverage ratio

he DSCR calculation is rather simple. A business’s DSCR is calculated by taking the property’s annual net operating income (NOI) and dividing it by the property’s annual debt payment. The DSCR is typically shown as a number followed by x.

DSCR Investment Loan - Eligibility

Income limits apply and may change based on geographical areas. A minimum credit score is required.

Income

Your income limits depend on your geographical area. Some areas do not have income limits.

Credit Score

Applicant should have the bank specified credit score beginning at 640 +

DSCR

The higher your DSCR, the more income you have to pay off your debt.

Features of DSCR Investment Loan

All loans are not created equal, DSCR Investment Loan has become a great option for people to use.

More likely to qualify for a loan

More likely to qualify for loan and receive an offer with better terms

Lower Interest Rates

Increases your chances of lower interest rates and a higher borrowing amount